Balance sheet google sheets template download#

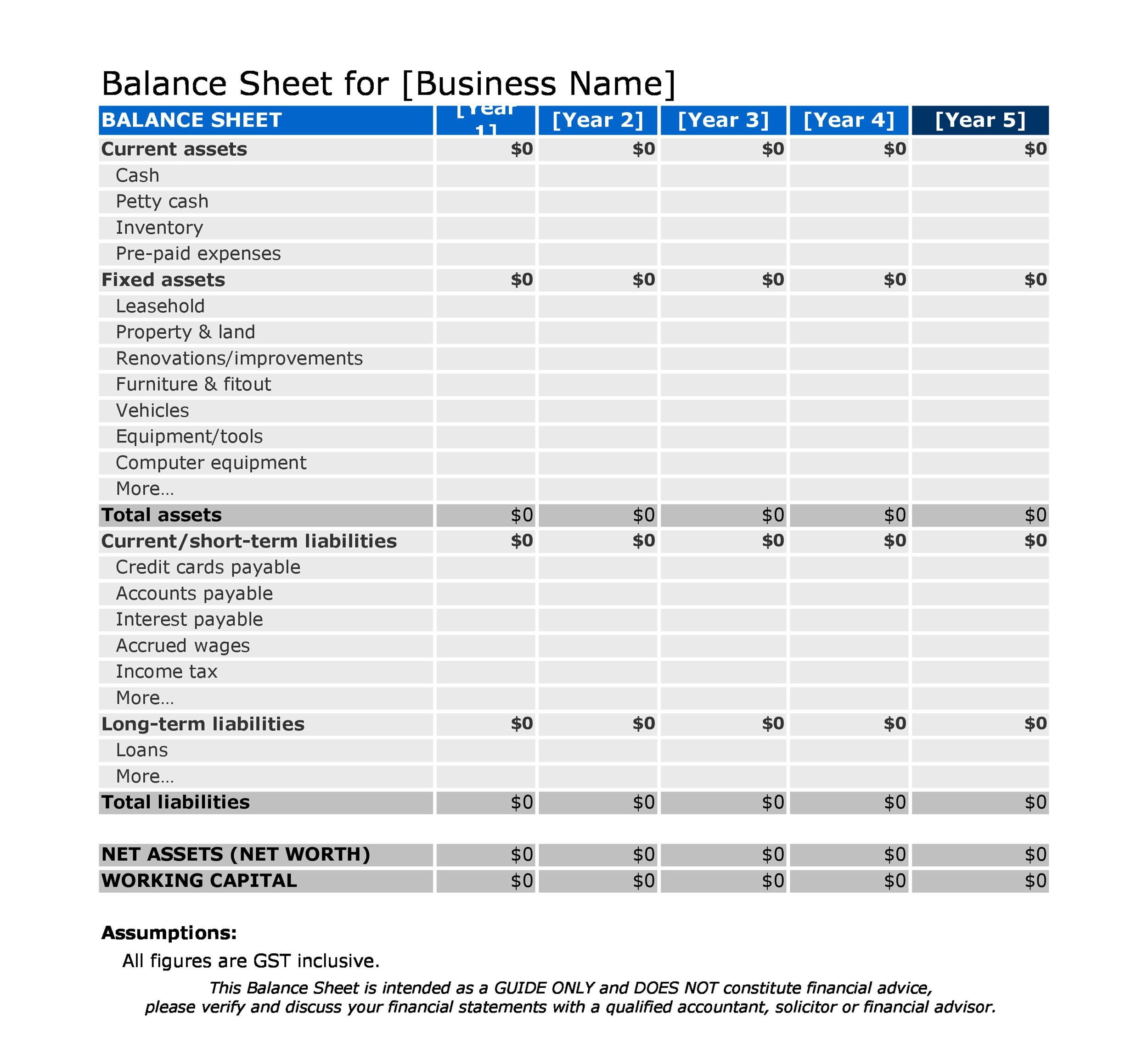

Instructions for Business Balance Sheet Template UKįollow the links below to download your free balance sheet template.Īt the top of the template, please enter your business name and the date to which it refers.

With practice, you will be able to use the accounting equation with ease and confidence.įor further information, read our section on the balance sheet. Luckily, once you understand the basic concepts, it is relatively easy to use this equation to create a balance sheet.

Balance sheet google sheets template how to#

Because it is such an important tool, it is essential for small business owners to understand how to use the accounting equation. The Balance sheet can be used to assess a company’s financial health and make decisions about investing, borrowing, and lending. The basic accounting equation is a fundamental concept in accounting that states that owners’ equity equals total assets minus total liabilities. Basic Accounting Equation on the Company’s Balance Sheet The profit or loss of the business will be taken from the income statement or also known as the profit and loss account this is the retained earnings. Owner’s equity is the amount invested in the business and profits or losses made (retained earnings). Long term liabilities include any long term loans an example is a mortgage on a property. They include accounts payable, short term loans and income taxes payable. Current LiabilitiesĬurrent Liabilities on the balance sheet are items your company owes over a short period, usually a year. Liabilities are classified as current or long-term. LiabilitiesĪ company’s liabilities are its obligations to pay back debts or provide services. Intangible Assets – These are not physical assets examples are copyright, trademarks, goodwill, and patents. Fixed assets are written off over a period of time by accumulated depreciation. They include equipment, fixtures, fittings, tools and buildings. Fixed Assets or Long Term Assetsįixed Assets or long term assets – Are used for more than a year. Current assets include cash, bank account, accounts receivable (amounts owed by customers), stock and prepaid expenses. The current assets are items that can turn into cash within one year, such as inventory and accounts receivable. The company’s assets are important because they represent the business’s resources to generate revenue. The assets can be divided into current assets, fixed assets, and intangible assets. The assets of a business are listed on the balance sheet and include cash, accounts receivable, inventory, buildings, and equipment. When preparing your balance sheet, it is helpful to understand the different parts of it. They also give stakeholders a better understanding of how a business is financed and how it generates cash. Balance sheets can be prepared for any period, but most companies prepare them quarterly or annually.īalance sheets are used by lenders, investors, and suppliers to assess a company’s creditworthiness and its ability to meet its financial obligations.

The balance sheet is one of the three significant financial statements (along with the income statement and cash flow statement) that businesses use to check their financial health. The goal of the balance sheet is to show how much a company is worth and whether it has the resources to pay its debts. A balance sheet is a financial statement that provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time.

0 kommentar(er)

0 kommentar(er)