- #Simple household budget excel how to

- #Simple household budget excel plus

- #Simple household budget excel free

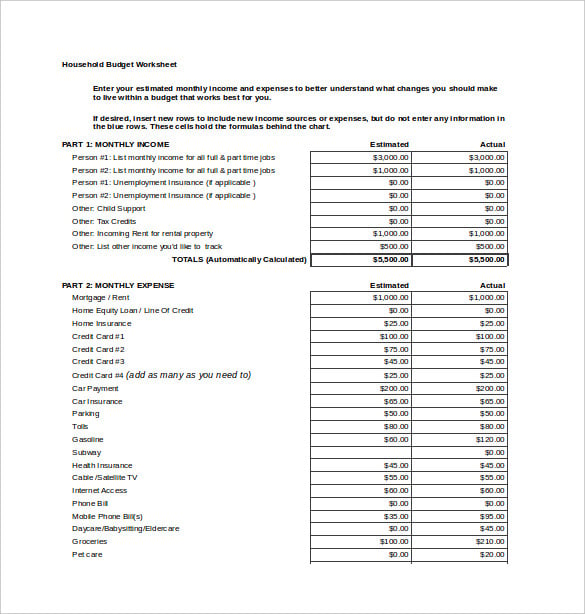

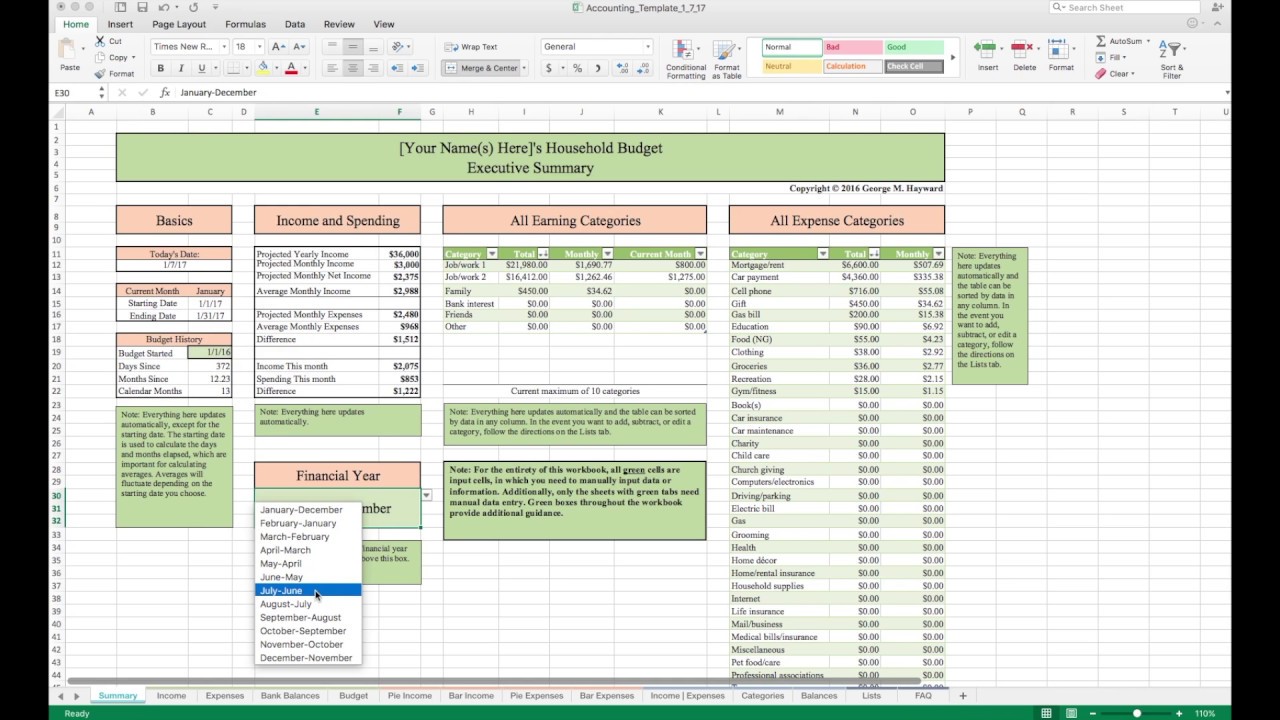

It’s a household budget that’ll record your monthly income, monthly expenses, and give you an idea of how much money you’re spending in each area.

Sometimes a handwritten budget like this can be a great first step before you move on to something fancier. It’s a simple personal budget that’ll make it easy to track your spending habits. If you’re just beginning to budget, or you just prefer writing it out, this one is a great first step ! 10 Easy Budget Templates to Track Spending EasilyĪ Basic Handwritten Monthly Budget Template There’s a variety of different templates here, but any of them should help you to get control of your finances and stop dreading the end of the month.

How Else Can a Simple Monthly Budget Template Help? When you see how much money you spend in each category you’ll then be able to start targeting expenses one by one. Īnd the easier your money management is, the more likely your financial health will improve.īudget templates make controlling your finances easier because they’ll show you an apples to apples comparison each month over the course of the year.īecause budget templates already have categories laid out, it’s quicker to record your monthly expenses. A budget template is usually a spreadsheet, or an app, that you’ll use on a monthly basis to track your spending habits. 50+ Ways to Save All Year Long.Ī template in general, is a tool that makes repetitive tasks easier.

#Simple household budget excel free

Free Monthly Budget Templates from Microsoft Office.Dave Ramsey’s “Every Dollar” Budgeting Tool.Personal Capital’s Free Budget Template.Free Budget Spreadsheets are Great, But What About Budgeting Apps?.

#Simple household budget excel plus

#Simple household budget excel how to

Many people spend their money without thinking about it, she adds, but you get to pick how to spend it so that it works for you. “Your budget is essentially a tool for empowering yourself,” explains certified financial planner Angela Moore of Orlando. For example, you may allocate specific cash amounts or percentages of your combined monthly income to various costs such as food, as well as savings, investment, and debt repayment. A family budget is a plan for your household’s incoming and outgoing funds for a specific period, such as a month or year.

0 kommentar(er)

0 kommentar(er)